Bitcoin: Weighing Benefits and Risks

As interest in Bitcoin continues to grow, its potential as a transformative investment becomes increasingly evident. What if you could secure your financial future with a digital currency that's often compared to gold? This article uncovers the compelling reasons why investing in Bitcoin may be a strategic move for your portfolio.

What You Will Learn

- Bitcoin has a strong historical performance, often delivering high returns compared to traditional investments.

- Dubbed 'digital gold', Bitcoin serves as a hedge against inflation due to its limited supply and decentralized nature.

- Incorporating Bitcoin into your investment portfolio can reduce overall risk and provide unique growth opportunities.

- The rise of institutional adoption, including Bitcoin ETFs, enhances its credibility and accessibility for everyday investors.

- Technological advancements like the Lightning Network improve Bitcoin’s transaction speed and reduce costs, paving the way for wider adoption.

- Bitcoin's decentralized architecture empowers individuals, offering an alternative to traditional banking systems and promoting financial security.

Bitcoin Investment: Benefits vs. Risks & Future Outlook

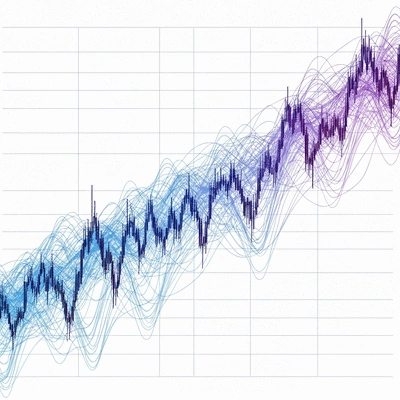

This visual summarizes the key benefits and risks of Bitcoin investment, alongside anticipated future trends.

Benefits of Bitcoin Investment

- 📈 High Return Potential: Historical performance insights.

- 🛡️ Inflation Hedge: Digital gold narrative.

- ➕ Diversification: Low correlation with traditional assets.

- 🏦 Institutional Adoption: Growing legitimacy.

Risks of Bitcoin Investment

- 📉 Market Volatility: Significant price fluctuations.

- ⚖️ Regulatory Uncertainty: Evolving legal frameworks.

- 🔒 Security Threats: Hacks and scams.

- Manipulation Risks: Impact on prices.

Future Outlook (Anticipated Trends)

- 📈 Increased Institutional Involvement: Greater legitimacy.

- ⚡ Technological Advancements: Improved efficiency.

- 📜 Clearer Regulations: Enhanced clarity.

- 🌐 Financial System Integration: Wider acceptance.

Next Steps for Potential Investors

- 💡 Understand Tax Implications: Legal considerations.

- 🗣️ Engage with Experts: Forecasts and insights.

- 💳 Choose Right Wallet: Security and user-friendliness.

Understanding the Value: Benefits of Investing in Bitcoin

When diving into the world of cryptocurrency, it’s crucial to understand the value of Bitcoin and what makes it an attractive investment. In this section, we’ll explore several key benefits that demonstrate why investing in Bitcoin can be a smart move for your financial future. From its historical performance to its unique positioning as a digital asset, let’s unpack the reasons why Bitcoin is gaining traction among both new and seasoned investors.

High Return Potential: Historical Performance Insights

Historically, Bitcoin has shown remarkable return potential, often outperforming traditional investments like stocks and bonds. Over the past decade, Bitcoin has seen substantial price growth, making early adopters quite wealthy. To provide a clearer picture, here are some noteworthy historical performance insights:

- Bitcoin surged from under $1,000 in 2013 to nearly $20,000 by the end of 2017.

- Despite fluctuations, Bitcoin reached an all-time high of over $60,000 in 2021.

- Many experts predict continued growth, with Bitcoin becoming a more mainstream asset.

With historical data in mind, it’s essential to approach your investment with an eye on future trends and potential. As the cryptocurrency landscape evolves, the possibilities for Bitcoin's value increase.

Bitcoin as an Inflation Hedge: The Digital Gold Narrative

As inflation concerns rise globally, many investors are looking for ways to protect their wealth. Bitcoin has been often dubbed the digital gold because it shares several characteristics with gold as a hedge against inflation. Let's look at why Bitcoin might fit into this narrative:

- Limited supply: There will only ever be 21 million Bitcoins in existence, making it scarce.

- Decentralized nature: Unlike fiat currencies, Bitcoin isn't controlled by any government authority.

- Increased demand during economic uncertainty: Many investors flock to Bitcoin when traditional markets falter.

This digital gold narrative positions Bitcoin as a valuable asset for those seeking stability in turbulent economic times. It’s a conversation worth having as you consider Bitcoin's place in your investment strategy.

Portfolio Diversification: Low Correlation with Traditional Assets

One of the most compelling reasons to consider investing in Bitcoin is its potential for portfolio diversification. Unlike traditional assets, Bitcoin tends to have a low correlation with stocks and bonds, which can help mitigate risks associated with market volatility. The U.S. Department of the Treasury has even highlighted the unique characteristics of digital assets and their potential impact on traditional financial systems in their DeFi Risk Review. Here are a few reasons why adding Bitcoin to your portfolio could be beneficial:

- Reduces overall portfolio risk by spreading investments across different asset classes.

- Offers unique growth opportunities that may not be available in traditional markets.

- Can improve overall returns, especially during periods when traditional assets struggle.

As you think about diversifying your investments, keep in mind how Bitcoin fits into this strategy. It might just be the missing piece in your financial puzzle.

Institutional Adoption: The Role of ETFs and Corporate Treasuries

In recent years, we've seen an increase in institutional adoption of Bitcoin, with significant players entering the market. Organizations like Tesla and MicroStrategy have added Bitcoin to their balance sheets, showcasing a shift in how corporations view digital assets. Additionally, the emergence of Bitcoin exchange-traded funds (ETFs) has made it easier for everyday investors to participate in the market. The Economic Report of the President further discusses the evolving landscape of digital assets and their integration into the broader economy. Here are some key points to consider:

- Increased legitimacy: Institutional investment signals confidence in Bitcoin's stability and future.

- Greater accessibility: ETFs lower the barrier to entry for new investors looking to gain exposure to Bitcoin.

- Potential for increased price stability as institutional money floods into the market.

This institutional trend reflects a growing recognition of Bitcoin as a viable asset class, which could contribute to its long-term value.

Technological Advancements: Innovations like the Lightning Network

Bitcoin continuously evolves, and technological advancements are key to its future success. Innovations like the Lightning Network aim to enhance transaction speed and reduce costs, making Bitcoin more user-friendly. Here’s how these advancements benefit investors:

- Faster transactions facilitate everyday use and increase Bitcoin’s utility.

- Lower fees make Bitcoin a more appealing option for both small and large transactions.

- Increased scalability could support mass adoption, driving demand and potentially raising prices.

As we see these innovations unfold, they bolster confidence in Bitcoin as a practical and functional asset, paving the way for its wider acceptance.

Decentralization: How Bitcoin Empowers Financial Security

At its core, Bitcoin is a decentralized currency that empowers individuals by providing an alternative to traditional banking systems. This decentralization promotes financial security in several ways:

- Users have full control over their funds without relying on banks or intermediaries.

- Transactions are transparent and securely recorded on the blockchain.

- Access to Bitcoin can be a lifeline for those in regions with unstable financial systems.

This empowering aspect of Bitcoin resonates with individuals seeking financial independence and security—an essential consideration for any potential investor.

Pro Tip

Did you know? Diversifying your investment portfolio with Bitcoin can potentially reduce overall risk. By adding Bitcoin, which often has low correlation with traditional assets, you may enhance your portfolio's resilience against market volatility. Consider allocating a small percentage of your investments to Bitcoin to explore its unique growth opportunities!

Wrapping Up: Summary of Bitcoin Investment Insights

As we conclude our exploration of Bitcoin investment insights, it’s clear that this digital currency offers a unique blend of benefits and risks. Understanding these aspects can empower you, as an investor, to make informed decisions. From its high return potential to its role as a hedge against inflation, Bitcoin presents numerous opportunities. However, it’s crucial to also consider the volatility and regulatory uncertainties that accompany this evolving asset class.

Ultimately, a balanced perspective is vital. By recognizing both the upsides and downsides, you can navigate the complexities of investing in Bitcoin with confidence. Remember, knowledge is your greatest ally in the world of cryptocurrency!

Benefits vs. Risks: A Balanced Perspective on Bitcoin Investment

When evaluating Bitcoin investments, it's essential to weigh the benefits against the risks. Here’s a concise list to help summarize these aspects:

- Benefits:

- High return potential based on historical performance

- Bitcoin as a hedge against inflation

- Low correlation with traditional assets for diversification

- Institutional adoption increasing credibility

- Risks:

- Extreme market volatility can lead to significant losses

- Regulatory uncertainty may affect investment strategies

- Security threats from hacks and scams are ever-present

- Market manipulation risks can impact prices

By understanding these key points, you can better assess whether Bitcoin aligns with your investment goals. It’s about finding the right balance for your portfolio!

Future Outlook: What Investors Can Anticipate in 2025

Looking ahead to 2025, the landscape of Bitcoin and cryptocurrency investments is likely to evolve significantly. Here are some anticipated trends:

- Increased institutional involvement, leading to greater legitimacy

- Technological advancements improving transaction efficiency

- Potential regulatory frameworks providing clearer guidelines

- Continued integration of Bitcoin into traditional financial systems

As these changes unfold, staying informed will be crucial. Embracing a proactive approach to learning about these developments can position you to capitalize on future opportunities in the Bitcoin market!

Taking Action: Next Steps for Potential Bitcoin Investors

For those considering diving into the world of Bitcoin investments, taking action is essential. Here are several steps to guide you:

Understanding Tax Considerations: Legal Implications for Bitcoin Investments

Before making any investments, it's vital to understand the tax implications. Bitcoin is treated as property in many jurisdictions, which means any gains may be subject to capital gains tax. For a broader understanding of consumer protection in the crypto space, you can refer to insights from the Brookings Institution on protecting the public from crypto risks. Here are a few points to keep in mind:

- Track your purchases and sales accurately for tax reporting

- Be aware of different tax rates applicable to long-term vs. short-term gains

- Consider consulting a tax professional for personalized advice

Understanding these considerations will help you navigate the legal landscape and avoid any tax surprises!

Engaging with Expert Opinions: Forecasts and Insights for Savvy Investors

Staying connected with industry experts can provide valuable insights into market trends and forecasts. Here’s how you can engage effectively:

- Follow reputable cryptocurrency news platforms and analysts

- Participate in forums and discussions to gain diverse perspectives

- Consider subscribing to newsletters that focus on Bitcoin and crypto market analysis

By actively engaging with expert opinions, you can enhance your investment strategy and make more informed decisions.

Choosing the Right Wallets for Your Bitcoin: A Guide for Investors

Selecting a secure and user-friendly wallet is crucial for protecting your Bitcoin investments. There are several types of wallets available:

- Hardware Wallets: Ideal for long-term storage due to enhanced security

- Software Wallets: Convenient for daily transactions and easy access

- Mobile Wallets: Great for on-the-go transactions, but ensure they have robust security features

Each option has its strengths, so choose one that aligns with your investment style and security needs. Remember, safeguarding your assets is a top priority!

Frequently Asked Questions About Bitcoin Investment

- Q: What are the main benefits of investing in Bitcoin?

- A: The main benefits include high return potential based on historical performance, its role as a hedge against inflation (often called "digital gold"), its ability to diversify investment portfolios due to low correlation with traditional assets, and increasing institutional adoption which enhances its credibility and accessibility.

- Q: Is Bitcoin a safe investment?

- A: Bitcoin carries both benefits and risks. While it offers high return potential and diversification benefits, it is also subject to extreme market volatility, regulatory uncertainty, security threats like hacks and scams, and market manipulation risks. Investors should carefully weigh these factors and consider their risk tolerance.

- Q: How does Bitcoin act as an inflation hedge?

- A: Bitcoin is often referred to as "digital gold" because it shares characteristics like a limited supply (only 21 million Bitcoins will ever exist) and a decentralized nature, meaning it's not controlled by any single government or financial institution. These qualities can make it attractive to investors seeking to protect their wealth during periods of economic uncertainty and inflation.

- Q: What role does institutional adoption play in Bitcoin's future?

- A: Increased institutional involvement, such as corporations adding Bitcoin to their balance sheets and the emergence of Bitcoin ETFs, signals growing legitimacy and confidence in Bitcoin as a viable asset class. This can lead to greater accessibility for everyday investors and potentially contribute to more price stability in the long term.

- Q: What technological advancements are improving Bitcoin?

- A: Innovations like the Lightning Network are improving Bitcoin by enhancing transaction speed and reducing costs. These advancements contribute to increased scalability, making Bitcoin more user-friendly and practical for everyday use, which could drive wider adoption and demand.

- Q: What are the tax implications of investing in Bitcoin?

- A: Bitcoin is generally treated as property for tax purposes in many jurisdictions. This means any gains from selling or trading Bitcoin may be subject to capital gains tax. It's crucial to accurately track all purchases and sales and to consult a tax professional for personalized advice to navigate the legal landscape and avoid surprises.

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Bitcoin has demonstrated high return potential, often outpacing traditional investments.

- Considered a digital gold, Bitcoin serves as an effective hedge against inflation due to its limited supply and decentralized nature.

- Investing in Bitcoin can enhance portfolio diversification, reducing overall risk and providing unique growth opportunities.

- The rise of institutional adoption validates Bitcoin as a credible asset class, increasing accessibility through ETFs.

- Technological advancements, like the Lightning Network, improve transaction efficiency and scalability, boosting Bitcoin's usability.

- Bitcoin's decentralization empowers users by offering control over their funds and secure transactions, promoting financial independence.

Bitcoin Wallets in DeFi and NFTs

Secure Your Bitcoin Investments Today

Bitcoin Mining's Role in Security

Recovering Your Lost Bitcoin Keys

The Importance of Bitcoin Today