Key Mining Risks

- • Operational: Hardware failure, downtime.

- • Regulatory: Legal uncertainties, compliance changes.

- • Market: Bitcoin price volatility.

What if your next investment could change how you understand money forever? Bitcoin mining is not just about profits; it’s a critical process that secures a decentralized network, ensuring transactions are valid and trustworthy. Dive into the essentials of Bitcoin mining and uncover the layers of complexity that lie beneath this revolutionary technology.

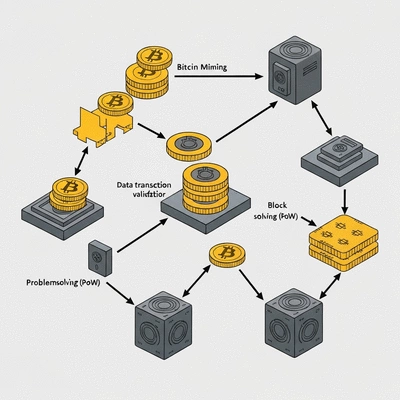

This visual illustrates the core process of Bitcoin mining and outlines essential strategies for mitigating common operational and regulatory risks faced by miners.

1. Verify Transactions

Miners collect and validate transactions.2. Create New Block

Verified transactions grouped into a block.3. Solve Problem (PoW)

Miners compete to solve complex math problem.4. Add to Blockchain

First miner adds new block to the chain.5. Receive Rewards

Miner receives Bitcoin for successful block.Have you ever thought about how Bitcoin mining works? At its core, Bitcoin mining is a process where powerful computers solve complex mathematical problems to validate transactions on the Bitcoin network. This process not only confirms transactions but also adds them to the blockchain, which is essentially a public ledger of all transactions. The miners are rewarded with Bitcoin for their efforts, making it an essential part of the cryptocurrency ecosystem!

Now, let’s break down the mining process further. When a miner successfully solves a problem, they create a new block, which is then added to the blockchain. This process is governed by a protocol known as Proof-of-Work (PoW). PoW ensures that transactions are secure and that the network remains decentralized. It’s like a giant competition among miners to keep the network running smoothly and securely.

Understanding Bitcoin mining goes beyond just knowing about transactions; it’s about recognizing how the entire network operates. Here’s a quick overview of the essential processes involved:

These steps highlight the complexities and the importance of mining in maintaining the integrity of the Bitcoin network. It’s a competitive and energy-intensive process, but essential for the network's security.

As I mentioned earlier, the mining process is not just about earning Bitcoin; it’s about securing the network. Each miner contributes to a decentralized system that allows for peer-to-peer transactions without the need for intermediaries. The more miners there are, the stronger the network becomes. This decentralization is what makes Bitcoin unique! Moreover, the Bitcoin Mining Council's Q2 2023 report provides valuable insights into the growth and sustainability of Bitcoin mining, demonstrating how the network continues to scale effectively.

The mining process is designed to become progressively harder as more miners join the network. This adjustment ensures that new blocks are created approximately every ten minutes, keeping the flow steady and manageable.

Now, let's delve into the significance of Proof-of-Work. This mechanism not only secures the network but also prevents malicious attacks. By requiring miners to expend computational resources, it becomes prohibitively expensive and impractical for any one entity to control the network.

In addition to PoW, miners must also implement various security measures to safeguard their operations. These can include setting up robust firewalls, using secure servers, and regularly updating their software to protect against vulnerabilities. For a broader understanding of cybersecurity in the crypto space, the National Cyber Security Centre offers comprehensive guidance on cryptocurrency security.

The hash rate is another crucial element in mining. It refers to the computational power being used to mine and process transactions on the blockchain. A higher hash rate means a more secure network, but it also impacts your mining profitability.

Understanding these dynamics is vital for anyone looking to engage in Bitcoin mining. By optimizing your hash rate effectively, you can not only enhance security but also boost your profitability!

Here are some common questions about Bitcoin mining, addressing the key points discussed in this article:

As we transition to the next section, it’s essential to recognize that along with the opportunities in Bitcoin mining come various risks. Addressing these risks proactively can make a significant difference in the success of your mining operation.

What do you think about the risks associated with Bitcoin mining? Share your thoughts below:

When you're involved in Bitcoin mining, it’s essential to understand the risks that can impact your operation. At How Does Bitcoin Work, we believe that being aware of these risks is the first step toward successfully managing them. In this section, we’ll dive into common risks and effective strategies to mitigate them, ensuring that your mining efforts remain both profitable and secure!

Bitcoin mining comes with its own set of challenges that miners need to navigate. Here are some of the most common risks:

Each of these risks can have significant implications for your mining operation. For example, if your hardware fails, the downtime can cut into your potential earnings. It's crucial to develop strategies that address these vulnerabilities head-on!

Mining requires a substantial investment in hardware. However, what happens when that hardware fails? A sudden malfunction can halt operations, and the costs associated with repairs can add up quickly. Regular maintenance and monitoring can help reduce the risk of unexpected breakdowns, but what else can you do?

By taking these proactive steps, you can minimize downtime and ensure your mining operation runs smoothly and efficiently.

Another significant concern for Bitcoin miners is the evolving regulatory landscape. Governments around the world are continuously adjusting their stance on cryptocurrencies, which can affect your operations. It’s important to stay informed about local regulations and compliance requirements. For example, the U.S. Department of the Treasury's report on stablecoins highlights the ongoing efforts to regulate digital assets, which could influence future policies affecting Bitcoin mining.

By staying proactive about regulatory risks, you can make informed decisions that keep your business compliant and secure!

To navigate these risks effectively, implementing smart risk management strategies is essential. Here are some ways to enhance your mining security:

Having a business continuity plan ensures that your mining operation can withstand unexpected events. This might include everything from power outages to hardware failures. By outlining clear steps to take in a crisis, you can minimize disruptions.

Consider creating a checklist that covers the essential actions to take for different scenarios. This can guide your team in responding effectively when faced with challenges.

Insurance can be a vital safety net for Bitcoin miners. There are various policies available that cater specifically to cryptocurrency operations. This can include coverage for hardware damage, theft, and business interruption.

Having the right insurance policy can give you peace of mind, knowing that you're protected against unexpected events.

Finally, let’s touch on the importance of network security. In a world where cyber threats are ever-evolving, ensuring your mining operation is secure is crucial.

By prioritizing security measures, you can protect not only your mining hardware but also your cryptocurrency assets. Remember, a secure mining operation is a successful mining operation!

Here is a quick recap of the important points discussed in the article:

Bitcoin Wallets in DeFi and NFTs

As the world of cryptocurrency rapidly evolves, understanding Bitcoin wallets is more crucial than e

Secure Your Bitcoin Investments Today

What if I told you that securing your Bitcoin investment could be as crucial as choosing the right a

Bitcoin Mining's Role in Security

What if I told you that Bitcoin mining is not just about creating new coins but is a cornerstone of

Bitcoin Wallets in DeFi and NFTs

Secure Your Bitcoin Investments Today

Bitcoin Mining's Role in Security

Recovering Your Lost Bitcoin Keys

The Importance of Bitcoin Today